Special System for Okinawa

With the return of Okinawa to Japan, the Okinawa Tariff Action Program has been established to help build up the Okinawa tourist industry, protect and boost the local business and stabilize the living environment of Okinawan people.

The Tariff Action Program contributes greatly to the Okinawa economic development.

Okinawa regional duty free shop system

-You can purchase tax exempt imported products at reasonable price.-

What is Okinawa Regional Duty Free Shop System?

It was made in April 1998, by the Okinawa Promotion Special Measure, and is summarized as follows.

1.The Products Subject to ExemptionAs to imported products which are purchased from a retail dealer approved by the Director General of Okinawa Regional Customs, domestic travelers from Okinawa to mainland Japan can purchase them at Customs duty free prices with an allowance of 200,000 yen.

2.Where to PurchaseNaha Airport Domestic Terminal or the designated shop in the city(designated by the Prime Minister).

3.PurchasersDomestic travelers from Okinawa to mainland Japan(The boarding passes of the airplane will be checked when they purchase the products.).

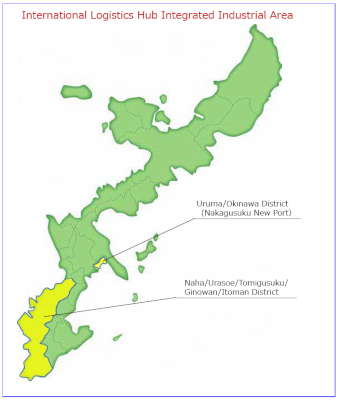

International Distribution Base and Industry Cluster Zone

International Distribution Base and Industry Cluster Zone in Okinawa is a mixture of the Hozei Area System regarding the Customs Law and the preferential treatment of finance and taxation system on the local business, based on the Okinawa Promotion Special Measure. It is the only area designated in Okinawa, which promotes the business and trading.

Functions of International Distribution Base and Industry Cluster Zone are as follows

1. National (Japan) tax Incentives

① Income Deduction

② Investment tax credit (ITC)

③ Special depreciation system

2. Customs duties Incentives

④ Application of selective system for customs duties

If you withdraw (import) products processed or manufactured from foreign raw materials at

a customs factory, or similar, in International Distribution Base and Industry Cluster Zone,

you are allowed to choose tariff rate either applied to the materials (excluding special items)

or the products, whichever is lower.

* Business authorization required from the relevant Minister.

⑤ Reduced customs bond permission fee

The customs bond permission fee will be halved for Customs Warehouse, Customs Factory,

Customs Display Area, and Integrated Bonded Area.

* Business authorization required from the relevant Minister.

3. Local taxes Incentives

⑥ Corporate enterprise tax exemption

⑦ Real estate acquisition tax exemption

⑧ Fixed asset tax exemption *Except warehousing businesses

⑨ Business office tax exemption *Naha city only

*Source:Okinawa Prefecture Industrial Site Guide(2024-2025)